AMP UP YOUR REPORTING AND PREPARE FOR FREQUENT ASKS

ABILA ARTICLE BY MICHELLE GARCIA 11.7.18

Particularly during a nonprofit’s growth periods, its finance team may be asked to generate reports on the health of the organization at any given moment. And, although most manage and prepare reports quarterly, bi-annually, and annually, the preference is to have the ability to provide reports based on current state. How can you be ready when the ask comes your way?

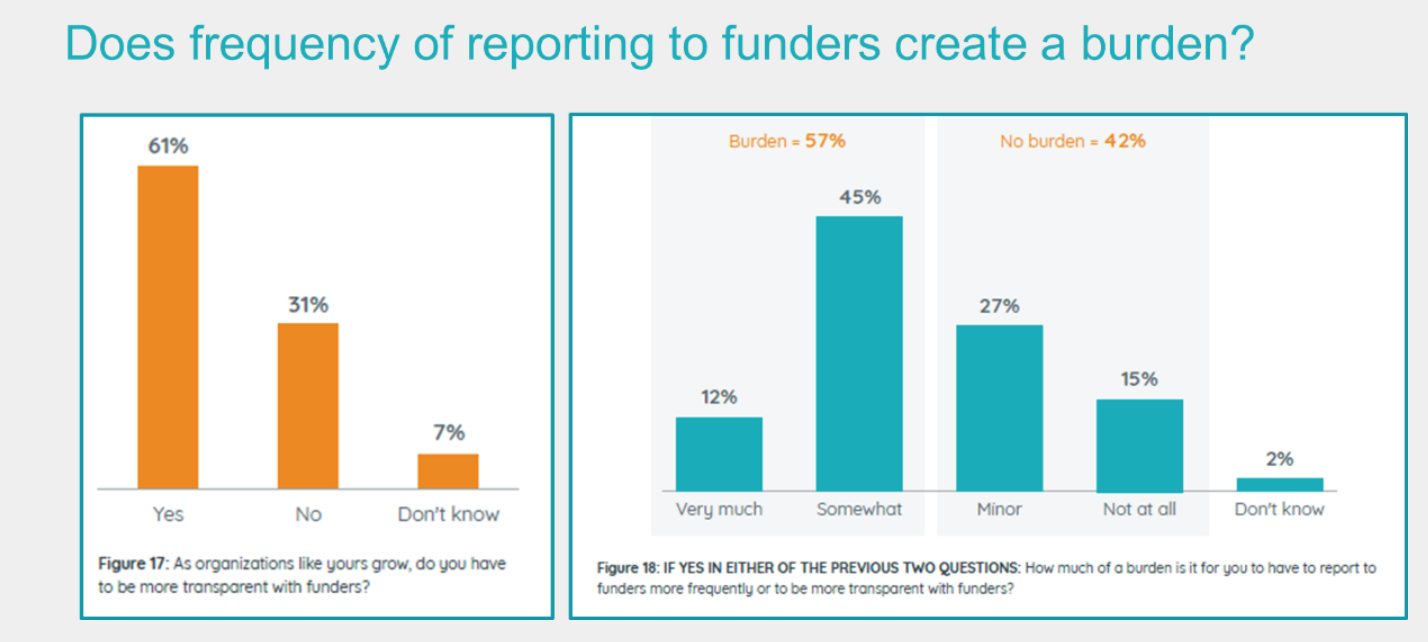

Before we jump in to potential solutions for more frequent reporting, see below for a few charts we garnered from our “2018 Nonprofit Finance Study” where your peers share their perspectives:

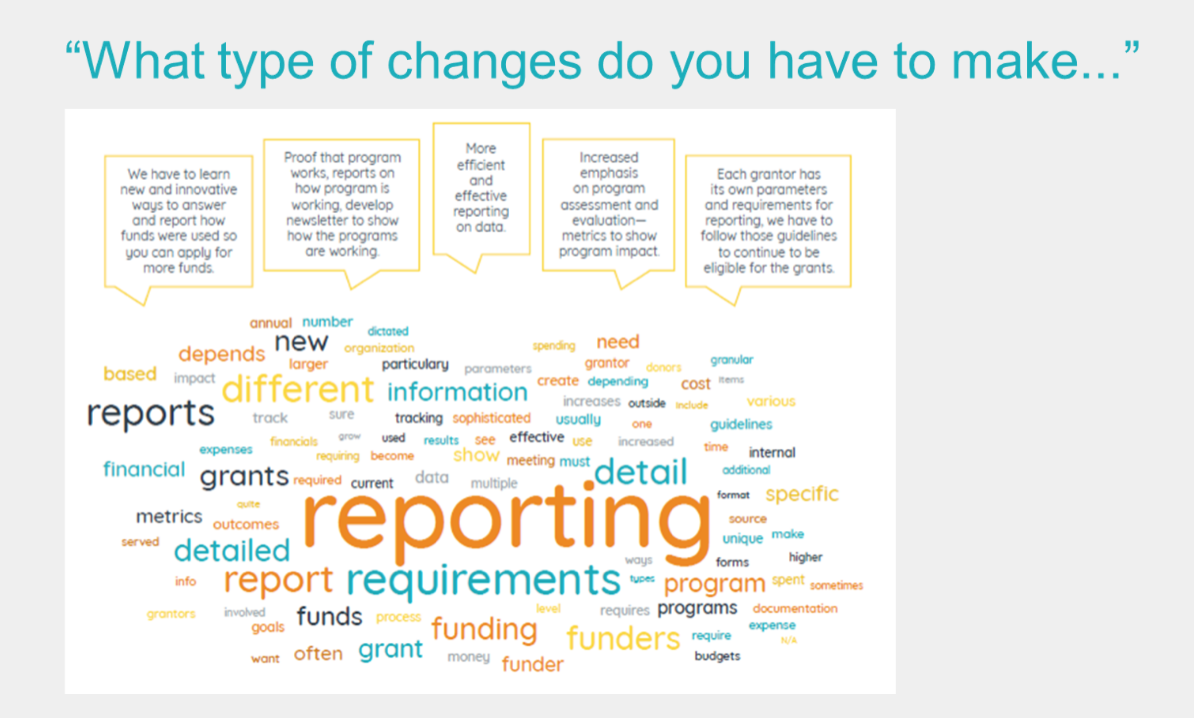

It’s reassuring to learn that a little more than 40 percent of responders don’t feel the burden of frequent reporting to funders. For those who do feel the burden, here’s what they’re saying they must do to respond to funders’ requests:

You can see from the keyword cloud, there are many types of changes getting incorporated to respond to funders during growth periods, even when reporting requirements may be different by funder and/or by grant. Users need more efficient and effective reporting on data. A good place to start is to increase emphasis on program assessment and evaluation – capture metrics to show program impact.

RECOMMENDATIONS FROM A COMMUNITY BRANDS EXPERT

Laura Reifschlager, Community Brands’ Implementation Consultant, recommends the following:

- As you increase services, your chart of accounts grows with you. Add the codes you need and budget for those new services.

- Growth is planned – that means strategically planning. Use a good a budgeting tool to include money for new services and use that to determine the new funding needed to support the plan.

- Make sure your organization and team use a tool that contains powerful reporting capabilities that include:

- Visual dashboards to help you spot trends instantly

- Drill down of data with filters, permitting you to see details for your key performance indicators (KPIs)

Producing accurate reports to convey transparency with your finances inspires confidence, which is the foundation to maintain funding.

- For careful planning for staffing growth, leverage an employee management tool or module, connected to your accounting software to enable efficient management of new employee requirements.

- Finally, for quick access to your financials and reporting (for example, anywhere, anytime login), seek out a cloud solution for your accounting system.

Other methods you can incorporate:

- Create general ledger (GL) groups for payroll tax analysis or benefits analysis.

- Set up groups by budget manager or set up groups by managers and department for easier reporting.

- Manage reports with executive view licenses. These license types allow additional users to run their own reports and assist with budget preparation, freeing you to focus on your management tasks.

At the end of the day, reporting should not be painful or burdensome. With an automated solution, you can replace that stress with ease.

If you have interest in learning more from your nonprofit finance peers, we invite you to contact us below for a download of the full study, “Nonprofit Finance Study: The Dynamics and Challenges of Growth,” and take a deeper look.

Why Use an Abila Business Partner?

1st Choice Advisors is a Select Business Partner for Abila products and services. Our consultants also have over 30 years of experience working with nonprofits; real-world experience with a variety of different types of fundraising needs and requirements as a result. We rigorously train on Abila products, hence spending up to 90 hours each year reviewing new functionality and training procedures. We are your go-to for service, providing user groups, both online and in our offices. All things considered, your satisfaction and ability to get results is our main goal!