Managing Nonprofit Challenges: Programs and Services

Many nonprofit organizations run programs and services as a means of fulfilling their mission and generating revenue. Those services are at the core of your mission and solidify your organization as a valued part of the community. But, managing nonprofit challenges, like billing and collections, can be complicated and can impact the organization financially – not to mention, programs and services may be covered by additional regulatory or financial tracking laws. Add in grants, designated to fund certain programs, and things become even more complex.

If managing fee-for-service programs is part of your world, true fund accounting software is critical to your success. A segmented account structure means you track every penny by program, grant, and even recipient. Then, you can customize your reporting to everyone from government agencies and the board of directors, to program managers and clients.

Revenue Management in Fund Accounting

Fee-for-Service Billing

Billing can be very complicated for managing nonprofit challenges in fee-for-service programs. Accounting must be accurate to the penny, without causing delays in cash flow.

True fund accounting software provides:

- Tracking by program and recipient to ensure timely and accurate billing

- Reporting on exactly which services have been provided to each client

- The ability to respond quickly to billing inquiries

- Integration with third-party billing services to prevent time-consuming duplicate data entry

Grant-Funded Programs

Programs and services are often not the only source of your revenue: grants and government funding can be critical. In this case, proper allocating, tracking, and reporting are essential to ensure your organization receives ongoing funding.

True fund accounting solutions are designed specifically for grant management, helping accountants:

- Create segments to allocate grant money across multiple programs and fiscal years, reflecting the way money is actually being spent

- Track eligibility for services and dollars at the client and program levels

- Use budget-to-actual reporting to ensure you’re optimizing the funds allocated to each program and participant

- Keep cash flow on track by ensuring that invoicing to programs is accurate

Expanding Your Mission

The more programs and services your organization offers, the more complex your accounting becomes. New programs, billing sources, and even locations, trigger new reporting requirements. It’s critical to have a solid financial system in place, to ensure the long-term viability of your nonprofit before you expand programs and services.

Keys to a strong accounting base for your nonprofit include:

- Creating the structure and segments that reflect the way your organization really works – no more exporting data and manipulating spreadsheets

- Customizing reports to reflect what each stakeholder needs, from summaries to client-level detail

- Budgeting for next year, knowing your history of strong compliance helps secure future funding

How Abila MIP Fund Accounting Can Help in Managing Nonprofit Challenges

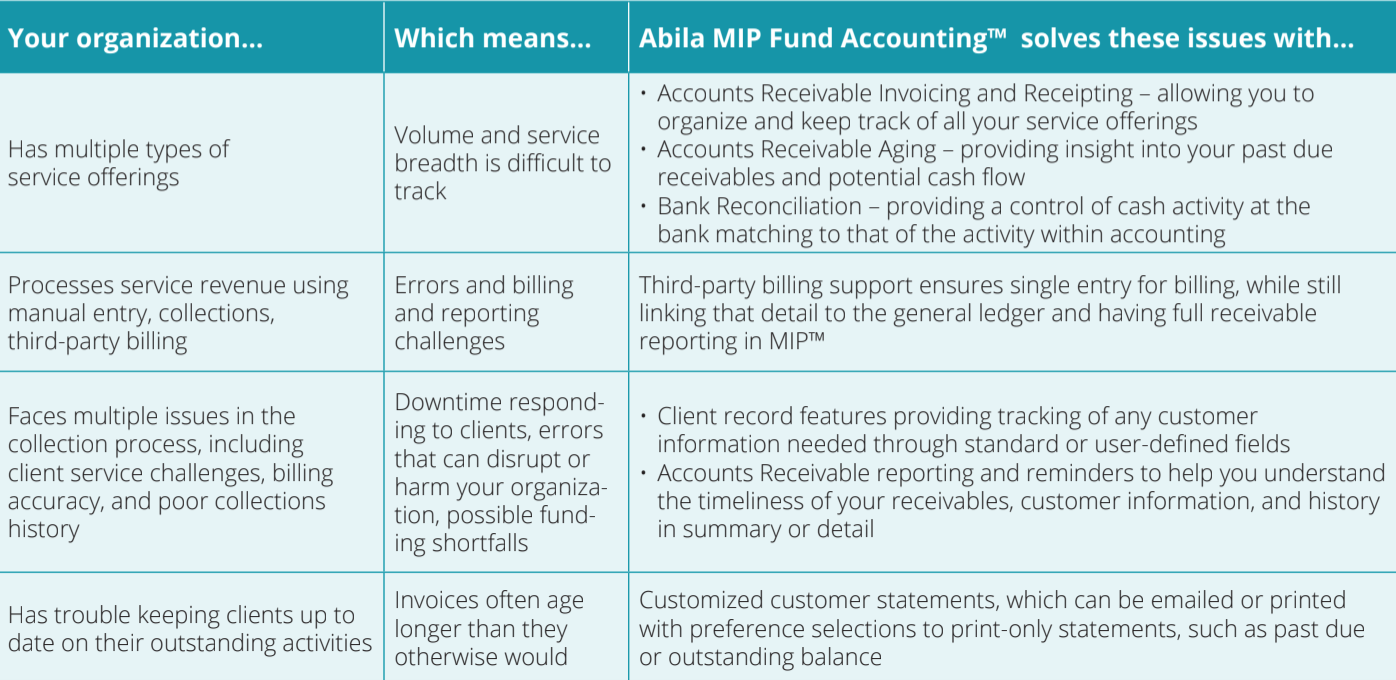

The chart below outlines the challenges and problems nonprofit organizations commonly face in accounting management. Browse the issues below and compare them to the issues you see everyday – they may not be problems you face now, but you need to ensure your accounting solution has the features and scalability to meet these challenges as you grow.

Abila MIP is designed especially for the fund accounting needs of nonprofits. If your organization offers fee-for-service or grant-funded programs, MIP gives you the solid foundation you need to help your organization thrive.

The MIP Advantage

- Customize reports for every stakeholder and filter dashboards to drill down to programs and grants for added visibility

- Accurately categorize programs and funding sources using segments

- Add program assignments at the point of transaction entry

- Allocate activities and employees across a range of programs

- Filter on specific programs, or roll up to groups of programs

- Easily create a segmented chart of accounts

- Apply grants across programs and fiscal years

Why Use an Abila Business Partner?

1st Choice Advisors is a Select Business Partner for Abila products and services. Our consultants also have over 30 years of experience working with nonprofits; real-world experience with a variety of different types of fundraising needs and requirements as a result. We rigorously train on Abila products. Why? We spend up to 90 hours each year reviewing new functionality and training procedures. We are your go-to for service, providing user groups, both online and in our offices. All things considered, your satisfaction and ability to get results is our main goal!

To learn more about a formal quote, data conversion and training:

- Email tfrancis@1stchoiceadvisors.com with your request.

- Contact us with general questions about our software!

- Fill out the form below with a brief message about your situation.